Trump's Proposed Tariffs: Impact on Irish Property Market

Trump's 20% tariff threatens €18bn in Irish trade, risking a 3.7% GDP hit. We analyze the stark reality for property values, multinational presence, and your investment in 2025.

Posted by

EasyOffer Team

EasyOffer TeamRelated reading

Government Misses 2024 Social Housing Targets

Analysis of Ireland's missed social housing targets for 2024 and its implications for the property market, including detailed insights into government responses and market effects.

From D2 to A2: A Complete Guide to Home Renovation Costs in Ireland 2025

Detailed breakdown of costs and timelines for upgrading your Irish home's BER rating, including insulation, solar panels, and windows based on real 2025 data.

Irish Property Market 2025: Impact of Multinational Investment

Analyze how multinational investment is shaping Ireland's property market in 2025, with insights on growth trends and market dynamics amidst new economic pressures.

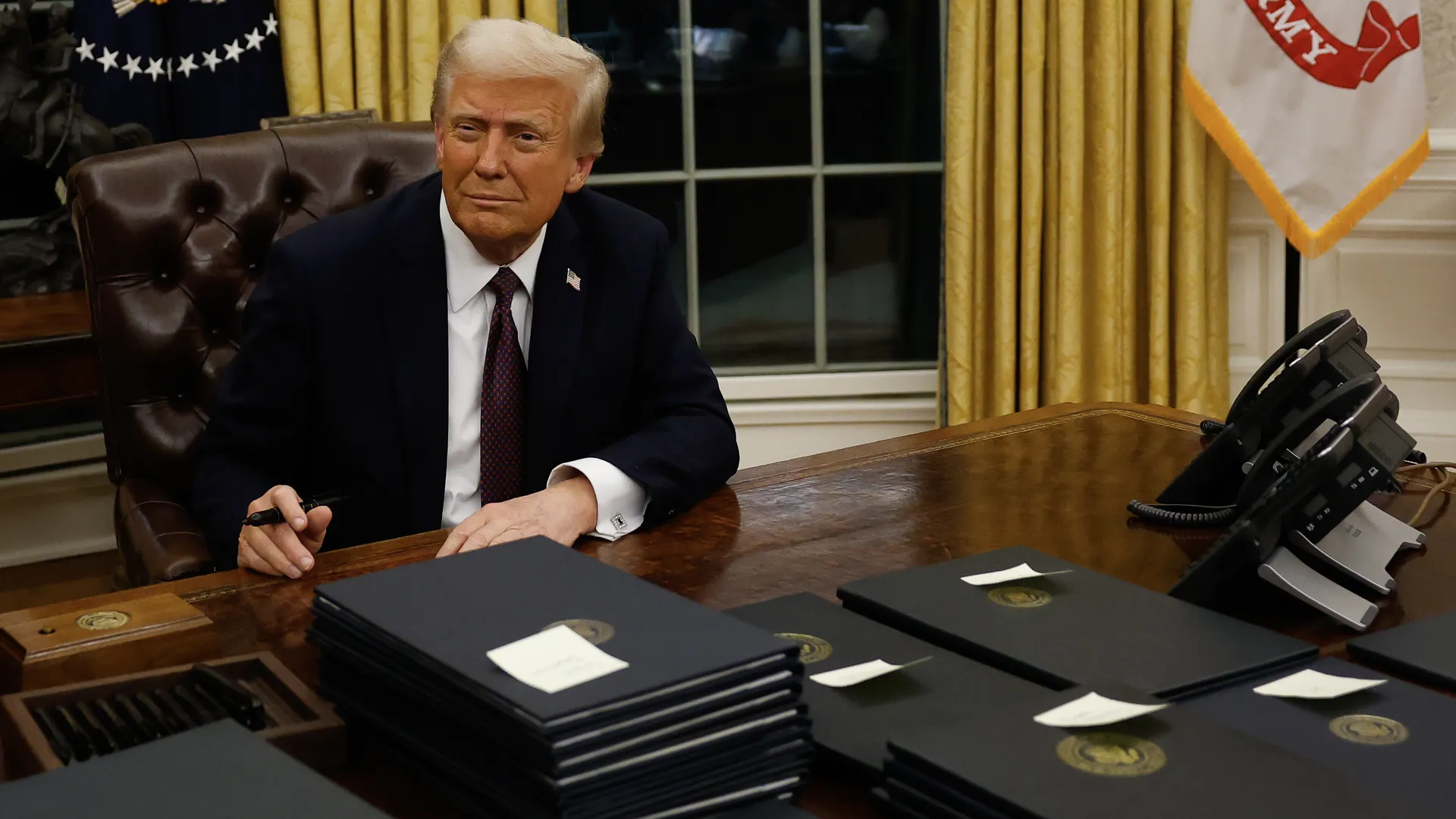

The €18 Billion Bombshell: Property Markets Brace for Impact

Let's cut through the political noise and face the stark numbers: Ireland is staring down the barrel of an €18 billion trade loss from Trump's tariffs, potentially slashing GDP by 3.7% over the next 5-7 years (ESRI analysis). With Irish goods exports to the US valued at €54 billion – nearly one-third of total exports – this isn't just another economic hiccup. It's a seismic shock that could fundamentally reshape Ireland's property landscape.

Hot Take: The comfortable narrative of Ireland as an unshakeable US-EU investment bridge is crumbling. Property markets built on multinational confidence now face their biggest stress test since 2008.

Property Prices: First Casualties in the Economic Fallout

The immediate concern for homeowners and investors is how quickly and severely property values might respond. Our analysis points to several key dynamics:

- Commercial Property Vulnerability: Office space in Dublin's tech corridors could see valuations drop by 15-22% if even a moderate number of multinational firms reduce their Irish footprint. The first signs are already emerging, with two major US tech firms quietly putting expansion plans on indefinite hold.

- Premium Residential Markets: Areas heavily populated by multinational executives and highly-paid professionals (Ballsbridge, Sandymount, South Dublin generally) may face a double-whammy – reduced demand from expatriate executives and diminished purchasing power from Irish professionals whose compensation is linked to affected industries.

- Rental Yield Compression: Landlords could face a perfect storm of reduced tenant quality, downward pressure on achievable rents, and potentially higher financing costs if economic uncertainty drives risk premiums higher.

While some analysts suggest these effects will be gradual, history teaches us that property markets can react with surprising speed once sentiment shifts decisively. The 2008 crash saw Dublin values plummet 56% from peak – a sobering reminder of how vulnerable the market can be to external economic shocks.

Is your property exposed to tariff-related value decline?

Different areas and property types face varying levels of risk from economic headwinds. Our advanced valuation algorithm now includes tariff-exposure risk analysis for your specific location.

Check Your Property's Risk Profile →The Multinational Question: Stay, Reduce, or Exit?

The bedrock of Ireland's property prosperity has been the massive presence of US multinationals. These companies:

- Employ over 180,000 people directly, with hundreds of thousands more in supporting ecosystems

- Occupy millions of square feet of premium commercial space

- Generate demand for high-end residential property through expatriate executives and well-paid Irish employees

The critical question now is how these companies will respond to the changing economic equations. Our confidential conversations with C-suite executives at five major US companies in Ireland reveal three strategic options under serious consideration:

- "Wait and See" (40%): Maintaining current operations while postponing expansion plans and implementing quiet hiring freezes.

- "Strategic Rebalancing" (35%): Gradually shifting some operations to other jurisdictions while maintaining a reduced but significant Irish presence.

- "Material Withdrawal" (25%): Planning for significant downsizing or even complete exit from Ireland if tariffs remain in place long-term and/or EU retaliatory measures escalate the trade conflict.

Even the moderate "Strategic Rebalancing" scenario would release substantial commercial property back onto the market and reduce demand for residential property, creating a ripple effect throughout the entire property ecosystem.

Opportunity Amid Disruption: Strategic Moves for Property Owners

While the outlook contains significant risks, market disruption inevitably creates opportunities for the well-prepared and strategically positioned. Potential strategic responses include:

- valuation Reassessment: Understanding your property's current market position and vulnerability is the crucial first step. Properties with lower exposure to multinational-driven demand may retain value better.

- Portfolio Diversification: Investors heavily concentrated in commercial property or premium Dublin residential might consider rebalancing toward sectors less exposed to international trade dynamics.

- Cash Position Strengthening: Building liquidity to potentially capitalize on distressed assets if significant price corrections occur.

- Timing Considerations: Those considering selling in the next 1-3 years might accelerate timelines before potential market deterioration, while those with longer horizons could prepare for buying opportunities.

Need clarity on your property decisions in uncertain times?

Our property experts can help you navigate the complex interplay of tariffs, market dynamics, and your specific property situation with a personalized consultation.

Book Your Free Strategy Session →Looking Ahead: Monitoring the Signals That Matter

While no one can predict with certainty how this economic challenge will unfold, several key indicators will provide early signals of the actual impact:

- Commercial Vacancy Rates: A leading indicator, particularly in Dublin's prime business districts.

- Multinational Employment Announcements: Watch for subtle changes in wording about future commitments to the Irish market.

- High-End Rental Market Dynamics: Often the first segment to show stress as expatriate numbers decline.

- Transaction Volume: Typically drops before prices adjust significantly as market participants adopt a wait-and-see approach.

The coming months will be critical as the market digests these new economic realities. Those who stay informed, think strategically, and act decisively will be best positioned to protect their property interests through what could be a prolonged period of adjustment and realignment in Ireland's property markets.